Prague offices: slow recovery

Prague office market recorded several “five-year“ negative records during the last year: decline in transaction activity (only 215,000 sqm were leased), highest vacancy rate (13.2 %) and lowest volume of completed new construction (mere 59,100 sqm). The fall of the Czech economy in 2008 and 2009 is visible with a traditional delay. Analysis by King Sturge, however, expects an overall improvement of the situation this year.

The expected development of three key indicators suggests a positive change: construction, demand and vacancy rate. 100,000 sqm of new offices should be completed this year, which is 66 % more than in 2010. Property developers are betting on market re-growth and they are willing to take a higher business risk – seven out of ten new buildings planned to be completed this year are being built on speculative basis. On the other hand, companies have been stabilizing their economic situation, this enables them to shift focus from strict cost cutting to creating mid-term development strategies. They include consolidation and optimalization of their operation, including efficient use of leased space. Currently prelease for roughly 35 % of area, which will be completed in 2011, is guaranteed. King Sturge expects a decline of vacancy rate to 12 – 12.5 % resulting from the recovery of the Czech economy.

Construction mostly speculative

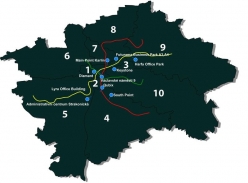

Some 100,000 sqm will be put on the Prague modern office market this year. One seventh of them is being built on speculative basis, ie. without a pre-agreed tenant. “Property developers which started speculative construction of offices in Prague in the second half of 2010 have a strong financial background that enables them to implement the above-mentioned projects. All companies rely mainly on their own financial resources, some of them also partially use bank financing from abroad. Private funding comes either from sales of completed projects or income from rented property,“ says Pavel Skřivánek, head of office properties department at King Sturge, and he adds: “Developers who are active in construction bet on the quality of their projects and market recovery in 2011 and 2012. Investing their private funds is certainly more expensive than bank financing but it gives them the freedom to start construction when the competition isn´t building and it allows to compensate more expensive private equity by lower construction costs, for example.“ Roughly a half of new office buildings, or areas that should be completed in 2011, will be built in Karlín, Prague 8.

Prague offices: projects for 2011

| Project | Area | Location | For who |

|---|---|---|---|

| Harfa Office Park | 19,600 m2 | Prague 9 | Speculative |

| South Point | 7,300 m2 | Prague 4 | Speculative |

| Main Point Karlín | 25,700 m2 | Prague 8 | Prelease |

| Administration centre Strakonická | 3,200 m2 | Prague 5 | Speculative |

| Keystone | 5,900 m2 | Prague 8 | Prelease |

| 9 Wenceslas Square | 2,300 m2 | Prague 1 | Speculative |

| Diamant – 3 Wenceslas Square | 5,000 m2 | Prague 1 | Speculative |

| Lyra Office Building | 6,500 m2 | Prague 5 | Speculative |

| Futurama Business Park II. Phase | 16,000 m2 | Prague 8 | Speculative |

| Qubix – STE 18 | 11,700 m2 | Prague 4 | Prelease |

Source: King Sturge, March 2011

Not everybody needs head office in the centre

“At the end of last year we started to record higher activity of tenants. We assume it´s related to the fact that a number of companies has stabilized and in addition to monitoring costs, they can focus on mid-term development objectives which include optimizing the operation and effectiveness of the leased space,“ Pavel Skřivánek says.

The real estate crisis, which brought pressure on cost reduction, has contributed to the emergence of the so-called patchwork offices in Prague 1. Given that the capital´s centre is the most expensive real estate location in the Czech Republic, many major companies located there pondered whether it is necessary to be right there and whether placing administration in a less exposed location would not be a better option. Last two major tenants moving from the centre are two banks (Komerční banka and UniCredit Bank). Smaller companies, for which the head office in the city centre is necessary for commercial and prestige reasons, remain in the centre of Prague. These include law firms, consultancies and recruitment agencies. The tenant mix is thus a reminiscent of a mosaic (or patchwork) of small and medium-sized companies.

Fewer vacant offices

In the first year of the crisis, ie. in 2008, record number of new offices were marketed in Prague real estate market (334,000 sqm). Given that the demand had not increased but remained at the same level, or began to decline, the overall vacancy rate rose. Until mid-2009, primarily vacancy of new buildings rose. This is mainly caused by the influx of large amounts of new space to the market and tenants´ inclination to cheaper rental options, ie. older buildings. The owners of new buildings responded with a wide variety of incentives which were used mainly by tenants who grew or optimized despite the crisis (typically pharmaceutical companies and later IT/Telco sector). Due to relocation of companies from lower-level offices to new buildings, a larger number of office buildings got to the market. In mid-2009 the vacancy rate in new and older buildings settled (at roughly 10.5 %) and later the vacancy rate of new buildings got below this indicator in old buildings. As to average “overall“ vacancy rate, King Sturge expects it to fall below 12 – 12.5 % at the end of 2011.

Prague offices – vacancy rate

| Period | Q1 2008 | Q2 2008 | Q3 2008 | Q4 2008 | Q1 2009 | Q1 2010 | Q1 2011 |

| Overall average vacancy rate | 5.95 % | 5.59 % | 8.96 % | 8.96 % | 10.5 % | 11.8 % | 13 % (estimate) |

Source: King Sturge/PRF

Jagg.cz

Jagg.cz Linkuj.cz

Linkuj.cz Google Bookmarks

Google Bookmarks Live bookmarks

Live bookmarks Digg

Digg Del.icio.us

Del.icio.us MySpace

MySpace Facebook

Facebook