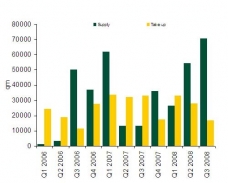

The gap between supply and demand for offices is widening

There are more and more rumours that something is not in order in the relationship between supply and demand in an ever-growing number of areas. The growing global pressure in combination with a lack of clients has already resulted in a slowdown of the investment market. The lower volume of transactions has caused discordance in the expectations of sellers and buyers. Only few of the investment plans observed in 2008 have been actually implemented. Modern office premises in numerous new-built complexes in Bratislava are not an exception. “If our hypothesis is that supply will not exceed demand, prices will definitely grow,” the representatives of the new Bratislava Research Forum (BRF) said about rents a short time ago. However, the global recession appears to have the power to make the lives of prognosticators very hard these days.

According to the end-of-year report by CB Richard Ellis (CBRE), which participated in the founding of BRF, the floor area of offices grew by more than 70,000 square metres in the third quarter of 2008 and reached a total of 1,164,000 square metres, but the demand for them did not follow this growth and took a downward turn. During the same period it dropped to 17,023 square metres, which constitutes a decline of up to 20% compared to the first three quarters of last year. The total volume of leased office premises during the period concerned reached 77,850 square metres and the rate of their vacancy grew from 5.75% to 8.3%. However, developers are highly reluctant to comment on this negative side of their projects, if you get them to make any comment at all.

Development of rents questionable

A running train won’t stop all of a sudden – by the end of 2008 the capital of Slovakia had another 30,000 square metres of new office areas, as expected. These were especially provided by the last tower of the Apollo Business Center II, AC Petržalka, IP Centrum and the first high-rise building of the Lakeside Park administration complex. According to 2009 projections, another 161,000 square metres of new office areas should be built in Bratislava. The main projects included in this figure are Digital Park II, Riverpark, Galvániho BC IV, Emporia Towers and Jarošova OC.

Even though the latest data for the last quarter is not available yet, BRF’s analyses indicate that the trend of inverse proportionality, or rather the widening gap between the growing supply in new administration buildings and the declining demand, is set to continue for some time due to its momentum. The question is how much this will influence the rents, which amount to EUR 18 at the maximum in the centre of Bratislava, while in the broader centre range between EUR 12 and 14 and outside the centre EUR 9 to 12. That is why BRF’s basic assumption from October last year, i.e. that there is some space for growing prices for the lease of office premises taking into account their long-term undervaluation, is questionable today, to say the least.

Industrial parks do not complain

Paradoxically there is a completely different situation in the sector of industrial parks. After the first three quarters of 2008 the leases of logistics areas reached a record-high value, exceeding the total volume of the previous year. The developers of huge administration complexes can only envy when they hear the following figure: in the Bratislava region the rate of vacancy decreased under the unbelievable value of 5%!

According to CBRE this optimistic picture can be, to a great degree, explained by the fact that Slovakia has become, thanks to its strategic position, a real magnet for the distribution centres of many international corporations, such as C&A, Takko and Whirlpool. The Senec Logistics Centre is a great example: a short time ago its developer, the real estate group Goodman, signed lease contracts with Hopi and Gebrueder Weiss as representatives of Whirlpool, Fiege and Logwin.

There are other important differences at play, such as the stable high demand and the fact that no new speculative industrial real estates were completed during the period in question. According to Petr Jánoši, director of CBRE’s Department of Industrial Parks, we can expect a switch from the currently prevailing speculative development projects to customized development projects tailored to the needs of specific clients, offering a distinctly lower degree of risk, because of the recent developments on financial markets and real estate markets. Last but not least, the success of industrial parks mentioned above is also partly attributable to the often trumpeted Slovak tax system and the forward-looking approach of the self-government.

Chart and visualization – CBRE / J&T

Jagg.cz

Jagg.cz Linkuj.cz

Linkuj.cz Google Bookmarks

Google Bookmarks Live bookmarks

Live bookmarks Digg

Digg Del.icio.us

Del.icio.us MySpace

MySpace Facebook

Facebook