Global crisis – a traumatizing factor or an opportunity for Slovakia?

This seemingly absurd hypothesis could paradoxically contain a grain of truth, if taken from the other end. At the time, for example, the question if Slovakia or any other country could look for a chance arising out of the global crisis could appeal provocative, or even naive. All surveys and statistics with many figures are absolutely clear and interpret the current events in the global economy as the harbinger of bad and even worse times. However, the smallest Central European country receives relatively the best ratings, acclaims and prognoses, voiced by well-respected international institutions in the last months. Can we transform this situation into our historical opportunity, or will the wave of all-encompassing recession swallow us and take us along with others to a place we don not know?

Even though we have the fastest-growing economy of the four Central European countries and our stability should be aided by the introduction of the Euro, according to expectations of some experts, none of them would be bold enough and bet everything that this almost “axiom” will definitely survive.

Investments in Central Europe declining

After a suspiciously long period of excessive optimism, we can now see a stage of gradual sobering and inner acceptance of external changes. The typical bad news started knocking on our door at the end of last year – one of the first being a report from CB Richard Ellis and Bratislava Research Forum that pointed at the slowdown of the investment market due to growing global pressures, smaller number of actually implemented projects and declining number of transactions.

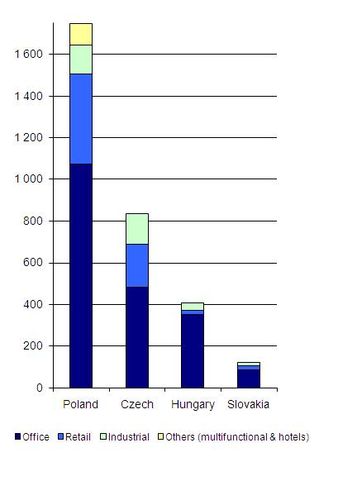

The latest survey by the worldwide real estate consultancy Cushman & Wakefield (C&W) does not bode well for the investment market in the whole Central Europe. Virtually in 2008 the slowdown of the global economic development resulted in its sharp plunge to the negligible three billion euros, which is only a half of the results typical for any period before that as regards the total volume of trading. According to C&W’s report, Poland managed to undertake relatively the biggest volume of real estate investments (EUR 1.747 billion), followed, after a long gap, by the Czech Republic (EUR 833 million), Hungary (EUR 407 million) and Slovakia (EUR 119 million).

Slovakia the negative favourite

Even though the volume of transactions in Poland was 42% lower than in 2007, it still remains higher than in 2004. The distinct drop in investment activities was caused by the impairment of banks’ credit capacity – at the end of the year most of them even halted loans in general, which forced many investors to clear away from the market.

As regards Hungary, last year’s volume of investments reached about EUR 407 million. Compared to the usual annual trading volume, which had been about one billion euros, this is a sharp decline. According to C&W it resulted from banks’ lower credit capacity, which “virtually drained all liquidity from the market”.

“There is no doubt that investors aiming at opportunities will dominate the market this year and will obtain primary real estates with higher revenues. In addition, they monitor the possibilities of obtaining money at reasonable conditions, which should be the case in 2009,” Charles Taylor, head of C&W’s investment team in Budapest, thinks.

In the course of 2008 the volume of investments in the three relevant sectors (office buildings, shopping centres / retail, industry / logistics) in the Czech Republic reached about EUR 850 million. “In 2009 the Czech Republic will host new types of investors in real estates. On the side of buyers the market will be dominated by opportunity-seeking funds that do not search for high risk and rather focus on more developed countries,” James Chapman, head of C&W’ investment team for the Czech Republic and Slovakia, prognosticates.

The situation in Slovakia is not too different, quite to the contrary: in 2008 the total volume of investments in the three main sectors was about EUR 119 million, which marks the biggest decline of all Central European countries, up to 60%. Because of the greater caution of foreign buyers, the number of large investment transactions also dropped last year. Almost a half of this volume constitutes funds owned by foreign entities, but seated in Slovakia.

2009 will be a crucial year

C&W is a recognized leader in global surveys specializing in real estates with a broad range of its own, regularly published reports. Underestimating its outputs would be a strategic blunder; the question is different: can the individual countries do anything, and if so, what specifically, to avoid the trend that snatches them away ruthlessly from the edge and takes them right into the middle of the crisis-invoked turbulence? The next discussion meeting of the Stavebné fórum.sk e-magazine will find an answer. It is called “Global Crisis = Opportunity for Slovakia” and will be held in the conference hall of Bratislava’s Art Hotel William on Tuesday, 20 January 2009.

The meeting, aimed at evaluating the business environment in Slovakia in 2008 and its 2009 outlooks, surveying the impacts of the crisis on our economy, adoption of the Euro as a stabilizing element at the time of recession, the possibilities of investment under changed conditions and the stricter bank policy as a new factor of real estate trading, will feature, through active participation, Róbert Kičina, of Slovakia’s Business Alliance, Martin Schuster of the National Bank of Slovakia, Ján Tóth of the Club of Economic Analysts, representative of the Institute for Financial Policy and Tomáš Osuský, of Ernst and Young, who prepared an analysis of the impacts of the crisis on Slovak and international companies a short time ago.

Table and chart – volumes of real estate investments in 2008

| Sector | POLAND (in millions) | CZECH REPUBLIC (in millions) | HUNGARY (in millions) | SLOVAKIA (in millions) |

| Offices | €1,074 | €481 | €349 | €85 |

|---|---|---|---|---|

| Shopping centres/retail | €429 | €207 | €21 | €21 |

| Industry/logistics | €138 | €145 | €37 | €13 |

| Other | €106 | - | - | - |

| Total | €1,747 | €833 | €407 | €119 |

Source: Cushman & Wakefield

Illustrative picture – J&T

Jagg.cz

Jagg.cz Linkuj.cz

Linkuj.cz Google Bookmarks

Google Bookmarks Live bookmarks

Live bookmarks Digg

Digg Del.icio.us

Del.icio.us MySpace

MySpace Facebook

Facebook