Mortgage market: from rapids to still water

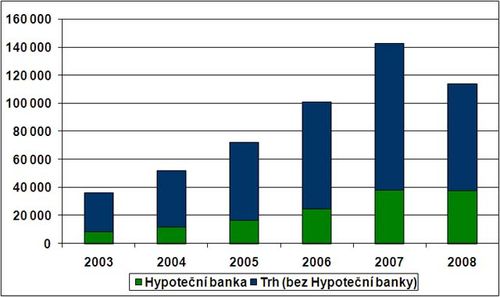

Twenty, thirty, fifty – if you add the “%” symbol to these figures and describe them as year-on-year changes in a macroeconomic indicator, every economist will spring to attention. Such movements can only signal an exceptional or very unhealthy situation. Perhaps the former applies to the domestic mortgage market, which has commonly experienced such shifts in loan volumes since 2000. Therefore, last year’s 20% decline (after years of increases of the same magnitude and even larger) does not have to be evaluated as catastrophic. The market is obviously entering a consolidation stage, which should have not only negative impacts on its players.

Last year’s slump in the volume of civil mortgages by about 20% was not surprising. In the course of the year, the banks started assessing the financial standing of loan applicants with stricter criteria and the number of rejected applicants climbed – e.g. in Hypotéční banka, their percentage is about 10% today, according to its CEO Jan Sadil. The mechanism of strong demand, which showed a promising start, climaxed in 2007 because of the alarm reports about the possible VAT increase and continued last year, came to a halt. The more so because banks started applying the same measures against developers, which reflected in increased requirements on their equity and pre-sales. And other alarms came in mid-year – this time not virtual, but with a real background. Recession is a scare that cannot go unseen, and the caution exercised by banks was doubled by higher carefulness among their clients.

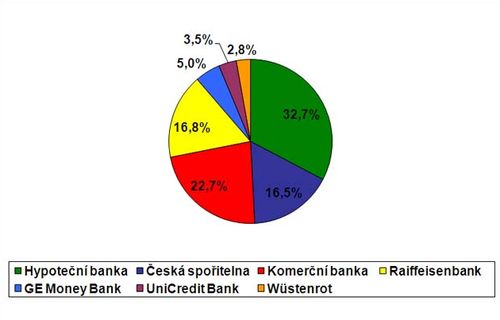

Market share of mortgage banks in % (2008)

Real and other reasons

“I have learned the answer to this question for several years. The volume of our bad debts does not exceed one percent of the total volume,” says Jan Sadil. The value of loans that are not paid in the long term (delay exceeding 90 days) has been stable for years, according to him. “I don’t think the share of bad mortgages will grow principally. However, some clients may run into new situations more often than in the past – they want to repay but cannot because they lost their jobs. But I’m optimistic and believe that there won’t be many such cases,” Hypoteční banka’s CEO is bold enough to make a forecast, although he considers any other predictions irrelevant given the prevailing conditions.

The data from the domestic No. 1 on the mortgage market are almost uniformly confirmed by other banks. “As regards mortgages for citizens, we haven’t recorded any significant problems yet. We expect certain worsening this year,” says Marie Petrovová, of Komerční banka. Tomáš Kofroň, of Raiffeisenbank, answers in a similar vein: “The share of unpaid mortgages is still far below one percent, we’ve seen no increase.” The same goes for Česká spořitelna: “We haven’t seen any significant growth in the share of unpaid mortgages,” says Pavla Langová, of ČS. Langová as well as Kofroň attribute this positive trend to the stricter assessment of the financial standing of loan applicants. Taking into account the expressly long-term character of mortgages, however, these steps could not so far influence the quality of the loan portfolio significantly. The good payment discipline among the clients of mortgage banks is obviously a general, long-standing trend.

And the same can be said of the general economy, specifically its loan sector. “Payment discipline is high here. The volume of classified loans is about 2 – 3% in the long run, below the EU average,” said Petr Zahradník, Director of the European Union Office of Česká spořitelna, at a recent discussion meeting. Data from the Czech National Bank confirms this fact. As far as housing loans (i.e. mortgages and construction loans) are concerned, the problems with their repayment are more or less constant. At the end of 2007, the Czech National Bank recorded only 1.5% of such loans with “debtor in default” (i.e. payments delayed more than 180 days), while at the end of last, critical year the share was 1.6%. As for consumer loans, the figures were 7.4% and 6.7%, respectively, i.e. the number of defaulting debtors even decreased.

All of this data more or less confirm what is generally known: banks did not have any real reason for their restrictive policy against mortgage applicants, unless we consider instructions from their foreign headquarters as such a reason. A short time ago, a Spanish economist asked a very interesting rhetorical question in this respect: “How do you want to carry out economic policy when you don’t have a single Czech bank?” The “different” situation turns out not to be able to protect the Czech economy against the impacts of economic problems in other countries. And the notorious inability of Western politicians, journalists and definitely also bankers to distinguish the Czech Republic from Chechnya and Slovakia from Slovenia certainly gives us little hope in this regard.

Volume of provided mortgages (in mil. CZK)

Moderate innovation

The decline in the volume of provided mortgages may even strengthen the marketing offensive of their providers. Hypoteční banka itself has already introduced two new features this year: Valentine’s Mortgage and Web Mortgage. While the former feature was a short-term event (time-limited savings on fees for loan processing), the web-based mortgage has a more permanent character and allows to settle most agenda electronically. On the other hand, Poštovní spořitelna offers free property appraisals and, just like most other banks, carries out all communication with the Land Registry on the client’s behalf.

All banks are preparing new products, with one exception. “We made last major adjustments in the offering of our mortgages last April, along with the introduction of a new product – Česká Spořitelna Ideal Mortgage. This year we will focus on the further development of this product,” said Pavla Langová, of Česká spořitelna. Quite obviously, mortgages are not the dominant product any more for what used to be the biggest market player. The former No. 1 became No. 4 last year (its market share was 16.5%), when the volume and number of mortgages decreased by more than 50%.

In spite of the optimistic expectations and a decrease in the Czech National Bank’s basic interest rates, the banks so far do not prepare any price and rate innovation. “Our rates do not depend on the Czech National Bank’s annual rates; we borrow money for a significantly longer period of time. At present we don’t plan any general rate modification,” explains Jan Sadil. Česká spořitelna says the same. “Adjustments of the Czech National Bank’s rates are just one of the factors that influence the final mortgage rate. The development of long-term rates on the interbank market will be crucial,” says Langová. Tomáš Kofroň, of Raiffeisenbank, confirms this: “The frequently mentioned repo rate by the Czech National Bank is more of a fictitious number. The interbank market is virtually dead, banks do not lend each other.”

This year’s outlook

According to first statistics, the mortgage market dropped by 44% in January, but nobody dares to make any principal evaluation of this first signal. “Our last year’s estimates were more optimistic that the reality. I see this year with a big question mark, it all depends on economic development and other factors. I believe, however, that the volume of mortgages can reach last year’s figure. But even if it were lower, I wouldn’t bee too surprised,” says Jan Sadil. It is similar everywhere and, following the recent total failure of all analysts, we cannot wonder. They are also careful in Raiffeisenbank, which managed to become the third biggest mortgage bank in the Czech Republic in the course of a few years, from a small market share of several percent. “At this time, any estimates are no better than crystal gazing. We can expect a general market downturn, but I don’t dare to estimate its scope,” said its spokesman Kofroň.

The weaker demand corresponds with the idle interbank market and the banks’ selective approach to mortgage applicants. “Taking into account the global economic situation, people postpone their long-term investments in higher volumes,” Langová points at one of the fundamental parameters of this year’s mortgage market development, and Milan Kříž, of GE Money Bank, adds: “There is some uncertainty, the customers don’t know what will happen with their jobs.” He argues with a recent survey commissioned by GE Money Bank. According to that survey, people especially want to save money – 6% all of their free money, 35% their larger portion. Almost half of the population will not spend any money, and 32% of the respondents argue that they have nothing to save. It is quite limiting on the potential demand, just like speculations concerning declining prices of flats, which the sellers of flats verbally deny, almost aggressively, yet it is something that is happening in reality.

The overall market downturn will also benefit building savings banks, long-term competitors of mortgage banks. For example in our No. 1 building savings bank, Českomoravská stavební spořitelna, the purchase of a flat or family house was the reason for 50% of the volume of the loans taken last year. The appeal of building loans is even higher because of the advantageous interest (3–4%), guaranteed in the long term, which the market appreciates today. Last year ČMSS provided 10% more loans than in 2007, and their total sum was CZK 33.4 billion. “The volume of loans for housing is growing dynamically. Compared to 2002, our savings bank increased its performance by 280%,” says Manfred Koller, CEO for ČMSS.

The Czech mortgage market is obviously entering another stage of its development. While it was smoothly driven on the rapid, yet non-hazardous rapids from the beginning of this decade, last year it hit still waters. Just like in rafting, picking up higher speed will require significantly greater efforts from all market players, and especially banks, than in the past. This year’s results so far – in February the volume of mortgages dropped to CZK 5.6 billion from CZK 8.4 billion the year before – illustrate the thickness of the current still waters quite truthfully.

Jagg.cz

Jagg.cz Linkuj.cz

Linkuj.cz Google Bookmarks

Google Bookmarks Live bookmarks

Live bookmarks Digg

Digg Del.icio.us

Del.icio.us MySpace

MySpace Facebook

Facebook