The World, European and Slovak retail market in the light of rents

According to the latest report Global Retail MarketView by CB Richard Ellis Company, which focused on the prices of rents in shopping centres and the analysis of regional or global trends, fell retail rents in practically all regions of the world in the 1st quarter 2009 as a result of the global recession and changes in consumer moods. Even when the pressure down surprised markets after several-year of enhancing, it can be expected that for facilities of multinational chains in the highest – first quality and the best placed (in a partner of a street or a shopping centre) will always be paid the rent according to the principles of free market.

Decline everywhere and regardless of the global scale

Despite more than 10-percentage average global decline New York (1800 $ / m2 / year), remains the World most expensive retail destination what is almost twice of the second city of the scale – Hong Kong (975 $). An interesting is the position of Moscow (790 $) on the third place in the scale of the most expensive retail localities, followed by Paris (776 $), Tokyo (771 $) and London (677 $).

After Australia Sydney (624 $) and Switzerland Zurich (612 $) Los Angeles (600 $) and San Francisco (540 $) are on the ninth and tenth positions of the global scale. Despite the evident signs of decline in rents, which can be seen in almost all the key American cities in the first quarter of 2009, the rate of non-occupancy of all types of properties in the U.S. continues to grow.

Even in major Asian retail centres leasing activity remained mostly poor in the 1st quarter of 2009. Retail marks report the postponing of expansion plans implementation to closing existing stores. Apart from the second position of Hong Kong with the rent of 975 $ per m2 per year, further decline was experienced in retail centres of Beijing, Tokyo, New Delhi and Singapore. The most expensive retail location of Pacific is Sydney (624 $ / m2 / year).

As a result of consumer behaviour directed to restrain spending and in many countries growing unemployment, however, the demand for retail premises fell in majority of the world markets. The most affected were developing and less established markets. Globally Buenos Aires (37%) experienced the biggest decrease of a rent followed by Warsaw (33%) and Washington (26%).

Region EMEA (Europe, Middle East and Africa) in the attenuation

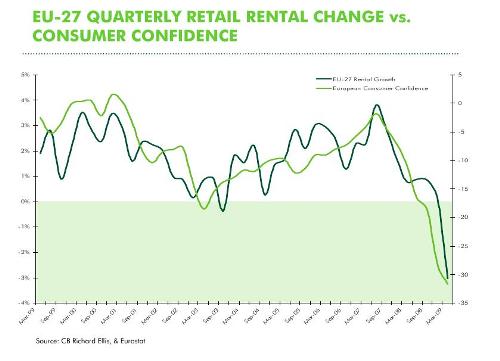

The threat of weaker demand and increasing number of vacant spaces caused to the „European twenty-seven“ (EU-27) the drop in retail rents by 3 percent during the 1st quarter of 2009, what is semi-yearly by 1.2 percent. The growth rate of European rents has been steadily declining since the half-year of 2007, whereas the semi-quarter decrease reached about 5 percent. Rents in retail premises of the first class fell in the concerned comparison even by 10 % or more, including Dubai, Barcelona, Athens and Dublin.

The demand from retailers is, in the most EMEA markets, attenuated, but there are also positives as well as a lot of discounts or plans for large expansion and extension of the operational networks announced by branded subjects of the food retail sector (Primark, Best Buy, Tesco and Sainsbury). In some markets are also known cases when retailers have reached substantial discounts in a rent or more favourable leasing terms in exchange for a long-tern lease agreement in negotiations with the owners of the premises.

Several of the major Western-European markets – except France, Italy, Portugal and the Netherlands – did not experience any movement of the revenues in the same quarter. This is clear evidence that the consequences become visible across the Central and the Eastern Europe, including a sharp decline in Warsaw and Bucharest.

EU-27: traders use market weakness to gain the benefits

An effect of the credit crisis and subsequent economic decline is now clearly demonstrated through the European retail sector. Retail rents are started declining in Europe mainly due to weaker demand and growing threat of job vacancies. The unemployment rate in the EU-27 grew by the end of March 2009 up to about 1.6 percent. An employment is a key factor in consumer confidence, which remains on a low level and deeply below its long-term average.

"Given the growing unemployment and weakening consumer confidence together with decrease in spending in most of the world markets have experienced reduction in demand from retailers and increasing number of vacant units, which in turn affects the rental… Some traders use the opportunity – weakening market conditions – to negotiate more favourable lease terms. Lessors in some cases are willing to compromise with the occupiers, who express the intention to go away. Others, however, have a tendency, in case of the best spaces, not to give up, in the belief that the empty shops are filled quickly, "commented Nick Axford, the director of EMEA Research and Consulting CB Richard Ellis.

On the other hand, recent indicators of business and consumer sentiment suggest the slight strengthening of trust, which may signal that the government's initiatives are finally beginning to bear its first fruit.

Slovakia: Shopping Park Market still active

The market of shopping parks construction in Slovakia was developing in recent years in comparison with neighbouring countries, with significantly more momentum – notes in contrary the latest report by Cushman & Wakefield (C & W). In comparison with the Czech Republic, where the parks were created during substantially longer period of time and in big cities at first, the enormous pace of development in our country was prompted by previous absence of this format, which foreign developers, entering the Slovak market, emerged.

Major players in the market of the shopping parks, recruit mainly from among the reputable companies which already have extensive experiences with this segment in other countries, continues the report of C & W, which ranks among them Austrian and Germany (MID Development at Bardejov, City Shop at Myjava, Family Center, Saller, Stop.Shop) but also British companies (e.g. Tesco, which construct further business units at Martin, Žilina and Košice).

Now the specificity: in comparison with neighbouring countries Slovakia as yet lacks the representation of local companies that would develop the concept of retail parks, according to C & W. Good coverage of the market has been achieved in Bratislava, Trnava, Trenčín and Nitra. But signs of changes exist in smaller towns, where „local residents“ benefit from excellent knowledge of the home environment. First results are expected in the Orava region and Ponitrie – in the regions outside the action radius of giant shopping-entertainment centres.

Slovakia is not a hermetically sealed room and the situation in retail units leases copies more or less with minor deviations the worldwide trend of the rate decrease. Reactions of tenants to the current state (in particular to the decline in turnover) and their initially bold expansion plans experienced certain corrections directed to reduction and even suspension of the commerce network expansion this year. A part of owners is also thinking of extreme solutions: to sell their own projects to operators, which do not know problems with the unavailability of funds. Similarly react also the developers who either slow down the pace of construction or concentrate on the careful preparation of projects, implementation of which postpone for the time of the renascence of the demand for this segment of real estates.

The area of retail parks in Slovakia exceeded 110 thousand m2 at the end of last year, which more than doubled compared to the year 2007. This year can be expected the completion of only 40 thousand m2 of new retail parks, thus their reducing to a third of the originally planned capacity, due to postponing a series of projects. Next year the other about 185 thousand m2 would be opened, but the rapidly changing situation is not able to guarantee this number.

Graphs, Tables, Map – CBRE / C&W

Jagg.cz

Jagg.cz Linkuj.cz

Linkuj.cz Google Bookmarks

Google Bookmarks Live bookmarks

Live bookmarks Digg

Digg Del.icio.us

Del.icio.us MySpace

MySpace Facebook

Facebook